Graded Guard captivate collectors and investors alike by blending history, aesthetics, and financial potential. However, this type of investment requires careful planning and strategic decision-making. For example, it is important to choose a trusted grading institution and stay informed about industry developments.

Moreover, seasoned collectors often seek out knowledge exchange opportunities by attending trade shows and participating in online communities. This helps them stay abreast of market trends and price fluctuations.

The value of collectibles can be determined by market trends, the condition of the item and its authenticity. Collectors can gather information from books, online forums and auction house catalogs. They can also visit museums and network with other collectors to gain insight into the market.

Collectibles can be an excellent diversifier to a traditional investment portfolio, providing a hedge against inflation and potentially increasing in value during economic downturns. However, investing in collectibles presents unique challenges including illiquidity, valuation issues and preservation requirements. Thoughtful estate planning strategies can mitigate these risks and ensure a smooth transition for heirs.

A collectible can be an artwork, antique, coin or trading card that is of special interest to a particular audience. In addition, it may be of historical importance or a symbol of a specific time period. Generally, rare items have greater value than mass-produced collectibles. For example, a Jeff Koons sculpture called Rabbit sold for $91 million in May 2019. This is because the sculpture is extremely rare and is considered an art work.

It is important to record and preserve all documentation pertaining to collectibles. This includes purchase records, documentation of origin, and authentication records. It is also necessary to keep track of any insurance and appraisals on collectibles. These records can be very helpful for future sales, taxation, and estate planning purposes.

Many people have inherited collections of stamps, coins or other memorabilia and are unaware that they hold real financial value. These types of items can be sold for a great deal of money, especially when they are in good condition and come from a reputable source. An appraiser can help determine the value of these items and provide advice on how to sell them for the best price.

Authenticity

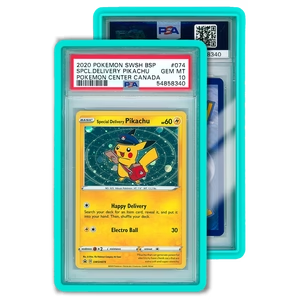

In the world of collecting, authenticity is a key element in the value of an item. For example, some collectors prefer a coin with a certain luster and strike designation. This is because these differences are considered a sign of authenticity. However, it is impossible to guarantee that a coin has a particular luster or strike designation.

Authenticity is about taking the road less traveled and doing what is right, not what is easy. It is about being genuine and caring for other people and horses. It is about making a difference in the world by sharing your unique talents and gifts with others.

Preservation

Preservation refers to activities that prolong the life of archival materials and prevent their deterioration. These activities include providing a stable environment for records of all media types, using safe handling and storage methods, copying unstable materials onto stable media (e.g., reformatting or digitization), mending tears in documents and preventing their further deterioration, and providing housings made from stable materials. Preservation also includes establishing pest control programs, implementing disaster recovery plans, and providing access to collections in the event of emergencies.

While preserving records is a complex undertaking, it is essential for society. The process involves identifying the social values that are served by preserved content, and it is important to balance this against the cost of preservation. Keeping in mind these values will help libraries make the best decisions regarding preservation strategies.

Preservation work is often seen as an investment, and it requires a careful balance of collection-level activities that can be difficult and expensive to manage but provide the greatest long-term benefit for the most materials, with item-level conservation treatment that may have limited impact, especially if the items are returned to a damaging environment. It is also critical to recognize that preservation efforts are ongoing and require a significant commitment of time, money, and energy. This is a significant challenge for archival institutions, which are already challenged by the need to meet many other demands on their resources.

Investment

When it comes to investing in collectibles, it’s always best to consult with experts. Start by talking to your financial professional, who can advise you on the impact of such investments on your overall financial plan. Then, work with specialists in the specific area you are considering, as these niche markets can shift quickly and have their own unique characteristics. For example, the classic car market has been on fire since fall 2020.

Brad Jenkins is a CERTIFIED FINANCIAL PLANNERTM with decades of experience in the financial industry, coaching advisors and helping clients achieve their goals. He is the creator of Market Guard, a proprietary investment strategy that empowers advisors and investors with a powerful new way to approach the markets.